From plunge to rebound: China's solar glass leader Xinyi Solar

In 2025, the stock price trend of Xinyi Solar (0968.HK), the leading solar glass company in China, staged a classic teaching case from the capital market for investors. The significant "time difference" between its stock price fluctuations and and the underlying industry fundamentals accurately reveals the deep operating logic of the capital market. This article aims to review and analyze this process, and provide an analytical framework for understanding the investment of cyclical industries.

Before starting, it is necessary to understand the core logic that drives the cycle of heavy-asset manufacturing industries such as solar photovoltaic glass: the "prisoner's dilemma" of production capacity.

This is a concept from game theory, which perfectly explains why the industry often falls into the cycle of "control to death, release to chaos". Specifically to the solar photovoltaic glass industry:

- Collective optimal choice (cooperation): All manufacturers jointly maintain production discipline and carry out limited and orderly capacity expansion. This can maintain the balance between market supply and demand, and everyone can enjoy stable high prices and high profits.

- The dilemma: Because every manufacturer faces the huge temptation of "betrayal" and is worried that others will expand production if they themselves do not, everyone tends to choose the strategy that is most beneficial to their individual interests: expanding production capacity. The end result is that all manufacturers rush in, the market quickly changes from a seller's market to a serious oversupply, prices collapse, and the industry as a whole falls into losses.

This situation is the fate of the solar glass industry, which is repeated again and again, and it is also the key to our judgment of the medium-term risks.

Review of 2025: Four stages of the "roller coaster" market

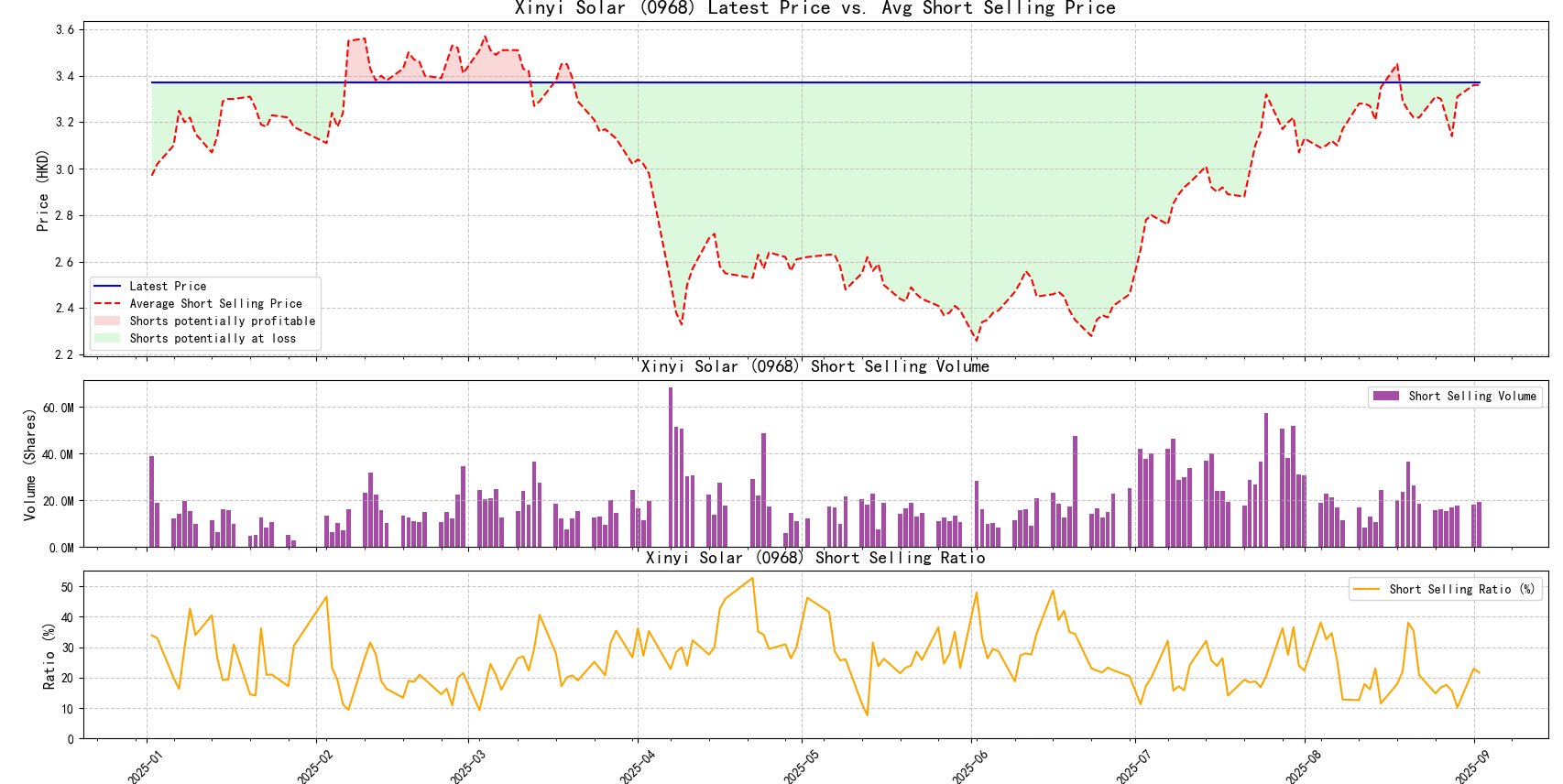

Since the beginning of the year, the share price of Xinyi Solar has gone through four stages, forming a complete picture of a "V"-type reversal superimposed on high-level consolidation.

- Phase 1 (January to mid-March): Stable operation and optimistic expectations. At the beginning of the year, the stock price was stable in the range of HK$3.0-3.5. At that time, the market news was good, demand rebounded after the New Year, and glass quotations even experienced a sharp rise at the end of February. The industry seemed to be emerging from the trough.

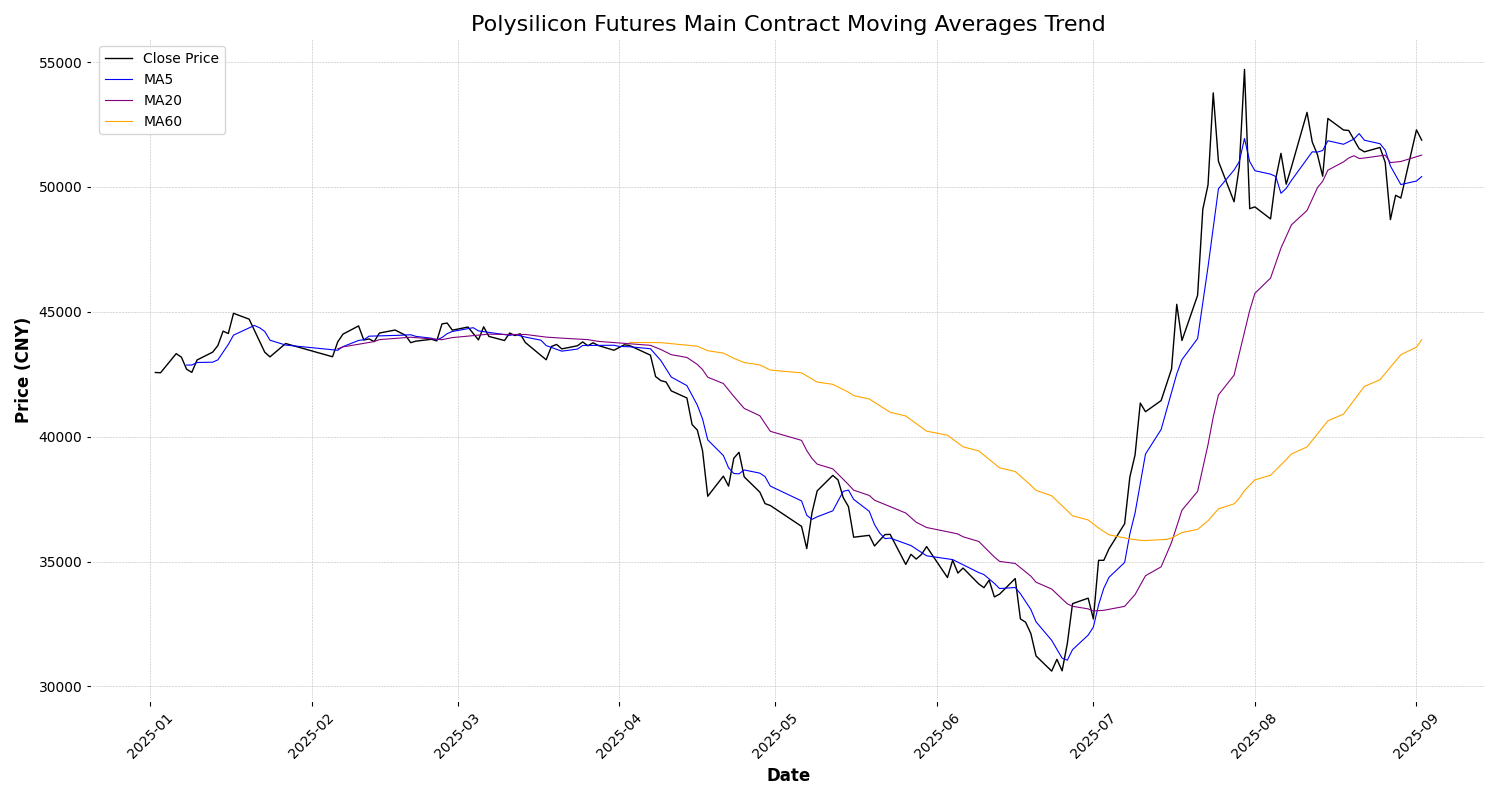

- Second stage (March 19 to the end of June): An Expectation Shift and a Stock Price Collapse. From March 19, the stock price began to fall sharply without any obvious direct negative news, and on April 7, it saw a massive plunge of nearly 20%, and then the entire Q2 was in the low position of about HK$2.4. In addition to concerns about the overcapacity of glass itself, another heavy "short signal" from the upstream of the industrial chain is the continuous plunge in the price of polysilicon futures. As the cost core of the photovoltaic industry chain, the collapse of polysilicon prices indicates that the downstream component sector will soon fall into a brutal price war.

- Phase 3 (early July to mid-August): The fundamentals bottom out and the stock price rebounds strongly. Entering July, with the implementation of the industry-level "self-help" large-scale production reduction and the hoarding behavior of downstream component factories, the market supply and demand relationship quickly reversed, and the spot price of photovoltaic glass bottomed out and rebounded. The stock price responded quickly to this, initiating a strong rebound and returning to above HK$3.0.

- Phase 4 (late August to date): High-level game. After the stock price recovered most of its lost ground, the upward momentum weakened and entered a high-level shock consolidation period, and the market's long and short forces launched a fierce game in this area.

Among them, the most thought-provoking node is undoubtedly the turning point of the decline on March 19. Why did the capital market "run ahead" and plummet when the industry quotation was still strong?

The Secret of March 19: The "Foresight" of the Capital Market

To explain this phenomenon, one must understand one of the core attributes of capital markets: forward-looking nature. Stock prices reflect not the published, well-known data, but the collective expectations of the market for the changes in the fundamentals in the next 3-6 months.

The stock price decline on March 19 was the result of the market pricing in advance the scenario of future "supply and demand imbalance." Although the quotation was strong at the time, professional investors had already captured two fatal leading signals through high-frequency data and industrial research:

- The risk of supply-side loss of control: The price rebound in February and March stimulated the irrational expansion of production capacity in the industry. News data shows that "the second round of kiln resumption has been fully launched" and "the favorable market had stimulated a surge in the number of kiln ignitions". For an industry with heavy assets and a long production cycle, this collective "stepping on the gas" on the supply side will almost inevitably lead to a serious oversupply in the next 1-2 quarters.

- The fragile foundation of the demand side: The recovery of demand after the Spring Festival largely depends on the policy-driven pulse-type rush installation, and its sustainability is questionable. Once the slope of demand growth cannot keep up with the speed of capacity release, price wars will be inevitable.

Therefore, the capital market has completed the deduction in March: the current optimism is short-lived, and the future surplus is certain. As a result, the stock price, as a "barometer" of expectations, reacted in advance, and the official decline in spot quotations in June was only a delayed confirmation of this expectation. The persistently high short-selling data also provided evidence for this shift in market expectations.

From "Industry Self-Help" to Stock Price Rebound: The Formation of New Expectations

Similarly, the stock price rebound in July followed the same logic. When the spot price in June and July fell below the cost line, the entire industry fell into losses, and the market's pessimistic sentiment reached its peak. However, it was this extreme predicament that gave birth to a turnaround in the fundamentals - a large-scale, organized production reduction action led by leading enterprises.

This action changed the core contradiction of the market and formed a new expectation: the supply side will be forced to clear, the inventory will decline rapidly, and the supply-demand relationship will be reversed in the short term. The hoarding behavior of downstream component factories under the psychology of "buying up but not buying down" further strengthened this expectation. As a result, the stock price once again led the repair of the company's profit statement and started the rebound ahead of schedule.

Future Trend

Given that 9/04 China's Ministry of Industry and Information Technology (MIIT) and the State Administration for Market Regulation (SAMR) recently jointly issued the 'Action Plan for Stabilizing Growth in the Electronic Information Manufacturing Industry 2025-2026,' market sentiment has begun to shift notably.

Short-term outlook (next 1-3 months)

Market sentiment has shifted from a "skeptical rebound" to a "policy-driven confirmed rally" and may trigger a "short squeeze." The government's strong intervention will completely ignite market enthusiasm and attract a large amount of funds that had previously been on the sidelines. Short squeeze: The high short selling ratio has become the most powerful fuel for the rise in stock prices under the current policy environment. The logic of all investors who shorted Xinyi Solar (the industry will return to the price war) has been broken by the policy. They will be forced to buy back stocks at any cost to close their positions and stop losses. This concentrated buying will further push up stock prices and form a "short squeeze".

Short-term forecast range: HK$3.60 to HK$4.30

Medium-term outlook (next 6-12 months)

The industry has entered a "new cycle of managed and high-quality development", and leading enterprises will enjoy the Davis Double Play of "valuation" and "performance" double improvement. Under the coordination of the government, the price of photovoltaic glass will be stabilized in a reasonable profit range. Xinyi Solar, as the leading enterprise with the best cost control, will be able to achieve continuous, stable and considerable profits. The company's earnings per share (EPS) forecast will be continuously raised by major institutions. Valuation increase (P/E increase): Due to the existence of the "policy bottom", the market no longer regards Xinyi Solar as a pure cyclical stock with large fluctuations in profits, but will give it a higher valuation premium because it represents the leading position in a regulated and stable market. When EPS (performance) and P/E (valuation) rise at the same time, the stock price will usher in the main rising wave. This is the strongest logic for a mid-term stock price increase.

Mid-term forecast range: HK$3.80 to HK$5.20

Key Price Levels Reference Table

| Category | Short-term (0-3 months) | Mid-term (6-12 months) |

|---|---|---|

| Strong Support | HK$ 3.50 | HK$ 3.70 |

| Key Support Level | HK$ 3.70 | HK$ 4.00 |

| Initial Resistance | HK$ 4.00 | HK$ 4.50 |

| Key Resistance | HK$ 4.30 | HK$ 5.20 |

Disclaimer: The content of this article is intended for general market analysis and opinion sharing only. All scenario outlooks, trends, and discussions are based on the exploration of publicly available information and analytical methods. They do not constitute, and should not be construed as, financial or investment advice. Readers are encouraged to conduct their own due diligence and consult with a qualified financial professional before making any investment decisions. Investing involves risks.